The Federal Reserve Board on Thursday produced its hypothetical situations for a 2nd round of financial institution pressure checks. Before this yr, the Board’s first round of pressure checks discovered that big banking institutions were effectively capitalized underneath a assortment of hypothetical gatherings. An extra round of pressure checks is being carried out because of to the ongoing uncertainty from the COVID celebration.

Massive banking institutions will be examined from two situations showcasing significant recessions to assess their resiliency underneath a assortment of outcomes. The Board will release company-unique effects from banks’ overall performance underneath equally situations by the stop of this yr.

The Board’s pressure checks support ensure that big banking institutions are capable to lend to households and firms even in a significant economic downturn. The training evaluates the resilience of big banking institutions by estimating their personal loan losses and cash levels—which offer a cushion from losses—under hypothetical economic downturn situations above nine quarters into the future.

“The Fed’s pressure checks previously this yr confirmed the energy of big banking institutions underneath lots of distinct situations,” Vice Chair Randal K. Quarles claimed. “Even though the overall economy has enhanced materially above the final quarter, uncertainty above the study course of the subsequent couple of quarters remains unusually large, and these two extra checks will offer far more info on the resiliency of big banking institutions.”

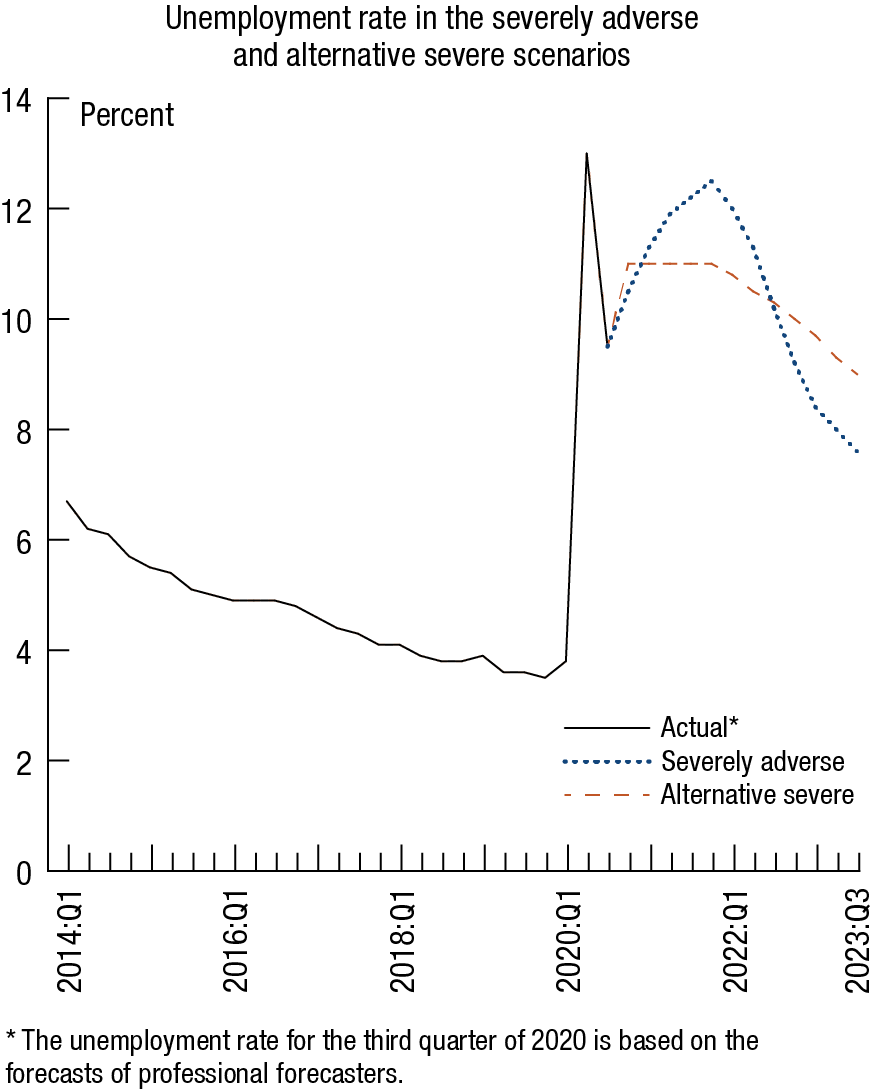

The two hypothetical recessions in the situations aspect significant world-wide downturns with considerable pressure in money markets. The first scenario—the “seriously adverse”—features the unemployment rate peaking at 12.5 p.c at the stop of 2021 and then declining to about 7.5 p.c by the stop of the state of affairs. Gross domestic product declines about three p.c from the 3rd quarter of 2020 by the fourth quarter of 2021. The state of affairs also options a sharp slowdown overseas.

The 2nd scenario—the “option significant”—features an unemployment rate that peaks at eleven p.c by the stop of 2020 but stays elevated and only declines to 9 p.c by the stop of the state of affairs. Gross domestic product declines about 2.5 p.c from the 3rd to the fourth quarter of 2020. The chart beneath displays the route of the unemployment rate for each individual state of affairs.

The two situations also include things like a world-wide market place shock part that will be utilized to banking institutions with big buying and selling functions. These banking institutions, as effectively as sure banking institutions with considerable processing functions, will also be necessary to integrate the default of their most significant counterparty. A desk beneath displays the elements that implement to each individual company.

The situations are not forecasts and are considerably far more significant than most recent baseline projections for the route of the U.S. overall economy underneath the pressure tests period of time. They are developed to assess the energy of big banking institutions in the course of hypothetical recessions, which is especially appropriate in a period of time of uncertainty. Every single state of affairs consists of 28 variables covering domestic and global financial exercise.

In June, the Board produced the effects of its annual pressure checks and extra analyses, which discovered that all big banking institutions were adequately capitalized. Even so, in light-weight of the heightened financial uncertainty, the Board necessary banking institutions to get many steps to protect their cash concentrations in the 3rd quarter of this yr. The Board will announce by the stop of September no matter if those actions to protect cash will be prolonged into the fourth quarter.

| Financial institution | Subject to world-wide market place shock | Subject to counterparty default |

|---|---|---|

| Ally Economical Inc. | ||

| American Specific Organization | ||

| Financial institution of The united states Company | X | X |

| The Financial institution of New York Mellon Company | X | |

| Barclays US LLC | X | X |

| BMO Economical Corp. | ||

| BNP Paribas Usa, Inc. | ||

| Capital A person Economical Company | ||

| Citigroup Inc. | X | X |

| Citizens Economical Group, Inc. | ||

| Credit score Suisse Holdings (Usa), Inc. | X | X |

| DB Usa Company | X | X |

| Uncover Economical Companies | ||

| DWS Usa Company | ||

| Fifth 3rd Bancorp | ||

| The Goldman Sachs Group, Inc. | X | X |

| HSBC North The united states Holdings Inc. | X | X |

| Huntington Bancshares Integrated | ||

| JPMorgan Chase & Co. | X | X |

| KeyCorp | ||

| M&T Financial institution Company | ||

| Morgan Stanley | X | X |

| MUFG Americas Holdings Company | ||

| Northern Belief Company | ||

| The PNC Economical Companies Group, Inc. | ||

| RBC US Group Holdings LLC | ||

| Regions Economical Company | ||

| Santander Holdings Usa, Inc. | ||

| Point out Avenue Company | X | |

| TD Group US Holdings LLC | ||

| Truist Economical Company | ||

| UBS Americas Keeping LLC | X | X |

| U.S. Bancorp | ||

| Wells Fargo & Organization | X | X |

For media inquiries, contact 202-452-2955

More Stories

Changing Business Strategies 2020

Starting Your Own Hat Wear Line – 7 Things To Know

Telecom POTS Line Project Risk Management