As pieces of the planet slowly but surely arise from lockdown, Kelly Chaaya is planning to commence her internship at a global lender. But the masters in finance college student at HEC Paris will not be likely into Citibank’s London business — as a substitute her function will be completed remotely.

Despite the unusual instances and economic uncertainty triggered by the coronavirus pandemic, Ms Chaaya is optimistic about her prospective customers in the finance market. “There will be some changes . . . but it is not likely to be as impacted as other sectors, these kinds of as the media,” she states.

But individuals completing their MiF programs now be a part of numerous other graduates who will have the complicated activity of developing a vocation in the course of a period of global economic shock.

Sentiment about internships and career delivers is mixed among business enterprise colleges and students, so it is complicated to predict how the landscape for MiF graduates will shift about the coming months. Broadly, nevertheless, there is a emotion that the finance market will hold constant.

Olivier Bossard, govt director of HEC’s MiF, states the only factual observation he can make for the business enterprise school’s graduates is that companies are delaying or shortening summertime internships. “The significant expense financial institutions are basically taking part in a pretty good-enjoy recreation with our graduates,” he states.

When it arrives to career delivers, individuals hiring from HEC are “still fully committed” to get persons, Prof Bossard adds. “Only a few firms so much have acknowledged that they would not be capable to honour their commitments.”

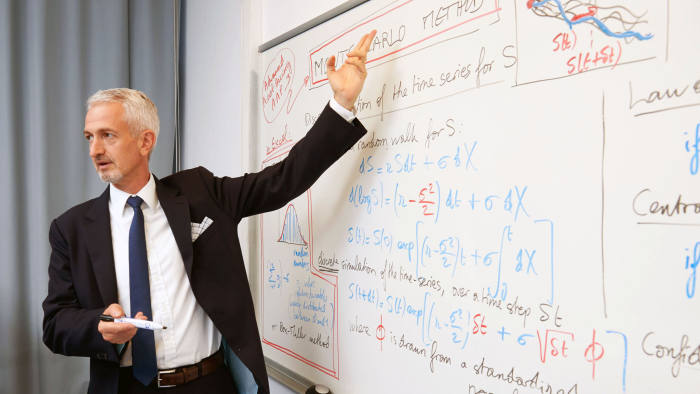

Overall he does not expect significant changes with expense financial institutions. He factors out that the pandemic has created a disaster in the genuine financial system. “Relative to 2008, the financial institutions are in a considerably superior form: extra liquidity, superior funds adequacy, risks are extra under control,” he states. While factors are alarming, “it is not, at minimum for now, a spectacular problem precise to financial institutions, or the financial sector.” Prof Bossard is extra worried about the consulting sector, which he thinks could be strike by value-conserving measures.

Anna Purchas, head of persons at experienced expert services organization KPMG, states that at this phase it is complicated to predict how the work opportunities marketplace in consulting will shift for MiF graduates. But “some areas of the business enterprise, these kinds of as restructuring, are likely to be pretty, pretty sizzling,” she states, “and that is an location the place a powerful analytical background and comprehending of business enterprise is incredibly helpful”.

The corporation has cancelled its summertime internship plan as it did not think it could give its candidates the finest knowledge, but some of individuals thanks to get element have been offered spots for the 2021 graduate ingestion.

In the US, having said that, Peter Cappelli, director of the Centre for Human Assets at Wharton Company College, states internships are being rescinded. He adds that, whilst the companies cancelling placements have not finalised conclusions on career delivers, “my guess is that individuals will be rescinded as well”.

Even so, Prof Cappelli thinks the finance sector could be significantly less affected than other folks “because finance and investing goes on”.

Christian Dummett, head of London Company School’s vocation centre, states the career marketplace is constantly modifying. In finance, asset lessons and subsectors drop in and out of favour, whilst technology has disrupted common companies. “Crises can accelerate this,” he states. But he thinks that “coronavirus is extra possible to have an affect on the way we function — from residence, significantly less vacation — rather than roles per se.”

Offered that MiF graduates encounter uncertainty and could be competing towards increased quantities of students for less work opportunities, what competencies do they have to have to be certain a lengthy-phrase vocation and how can they build them whilst studying?

Casper Quint, an MiF college student thanks to graduate later this year from London Company College, suggests that as soon as students get started their programme, they need to commence to build an thought of what they want to do. “Investment banking has a pretty distinct recruitment system from, for illustration, fintech,” he states.

LBS’s vocation centre assisted him plan his solution, whilst he also states students need to “reach out to alumni”.

Ms Purchas thinks a main ability is showing adaptability. Graduates have to have to preserve an eye on the place the marketplace is increasing and the place it is contracting, and think about how they can posture themselves.

“When I think about my vocation, it has been a portfolio vocation,” she states. “I think that truly is the way for persons to think about their occupations. There will be phases. You can understand from each [one], establish on it and transfer throughout.”

She adds that, whilst they are executing their MiF programme, students need to also be networking and studying from their peers, so they can exhibit that they can prosper among persons from assorted backgrounds.

Ms Chaaya states that whilst no one expects MiF students to be geniuses, they do have to have to know a ton about the specialized facets, as well as curious — “ask questions”, she advises. When interviews get started to develop into conversations rather than emotion like a grilling, the probability of achievements improves.

Despite the prospect of a tough period in advance, she suggests finance to anyone intrigued in operating with quantities. There is constantly function, she states, “in the good occasions and terrible times”.

More Stories

Accounting Implication of a Global Financial Crisis

Changing Business Strategies 2020

Starting Your Own Hat Wear Line – 7 Things To Know